With Great Uncertainty Comes Great Opportunity

Is the FED put back in play? Did you pick up on the subtle shift at the FOMC last week on March 19? To the casual observer it may have seemed like business as usual, holding rates steady at 4.25 – 4.5%. But what was it about this meeting that has people feeling a shift, a dovish one perhaps by the Fed Chairman, Jerome Powell during and following his speech.

So how did we get here? If you’ve been following headlines this past month, it has been quite the ride. Trump tariffs, global uncertainty, recession fears on top of the already growing inflationary risks all came to a critical level as the market saw a fast paced sell off reaching 10% drop in under 3 weeks. But as in past sell offs, are we facing structural risks, or merely a shorter term sentiment shift? To understand the data and where we are, you have to look under the hood.

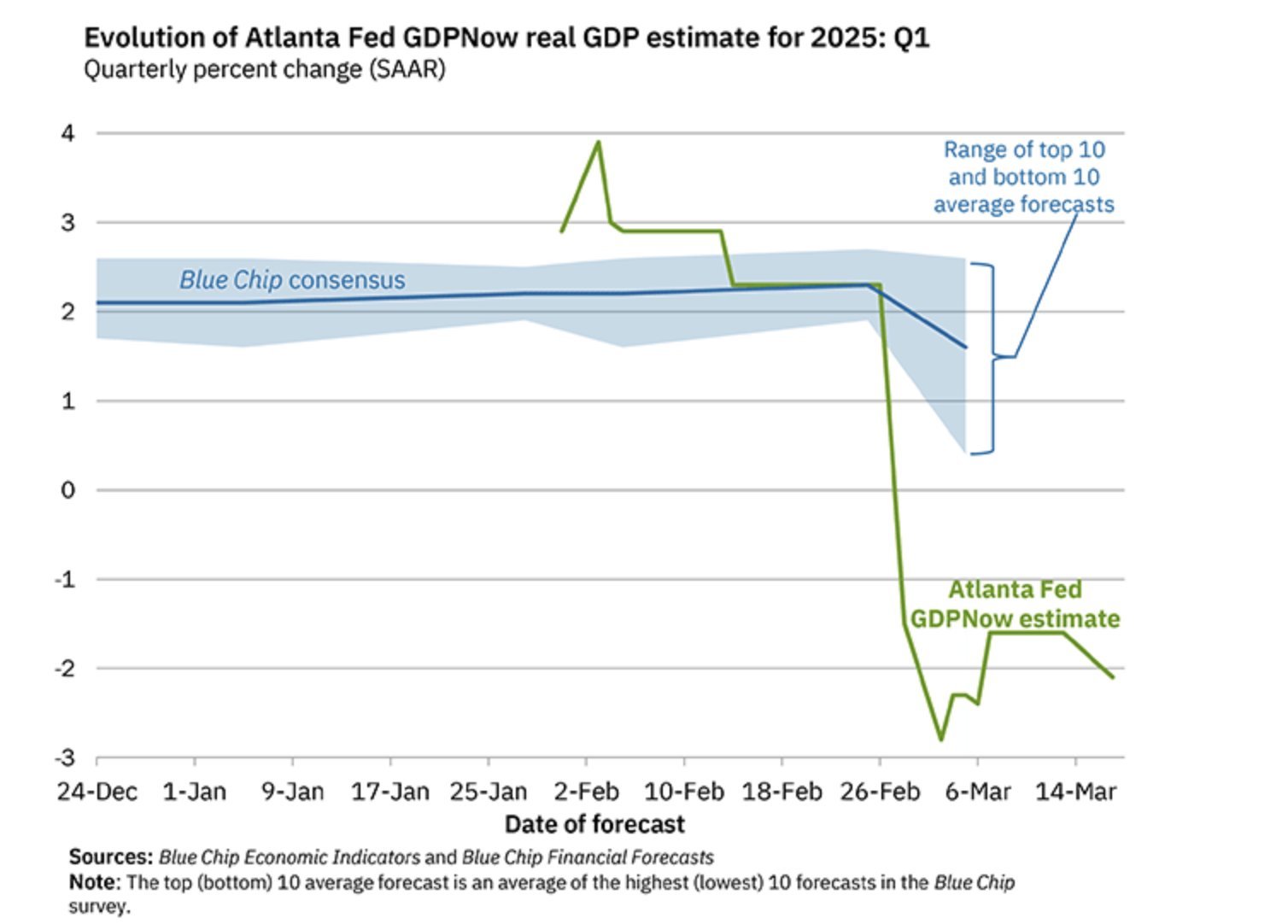

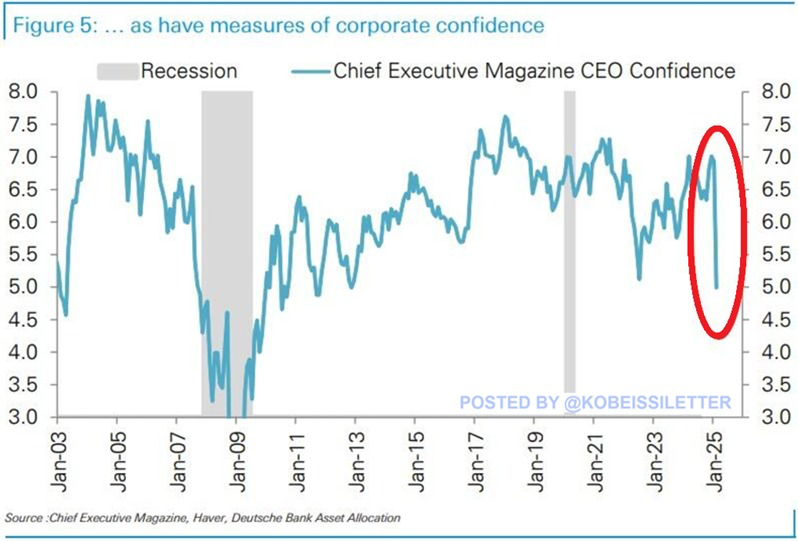

Atlanta Fed estimated Q1 GDP numbers caused sensational headlines earlier this month after being revised from +3.9% in early February, +2% in mid-February, and then absolutely cratered to a -2.8% estimate on 3/3. The media ran with these numbers, but digging deeper, the real cause for such a drastic drop? Gold imports! – That’s right, of all things, it was record Gold imports skyrocketing throwing off the data. The headlines did their damage and moved on to the next thing. Following shortly after, data showed CEO confidence drop to its lowest level in 13 years – that’s right – lower than the Covid Pandemic crash, lowest since the Great Financial Crash of 2008. Adding on top of this, non-stop talk about the impact of tariffs causing a recession combined with increased inflation, leading us to stagflation.

Atlanta Fed Q1 GDP Forecast showing the drastic drop.

Large incrase in Gold Imports beginning in 2025.

CEO Confidence levels dropped to levels not seen since post 2008 crash.

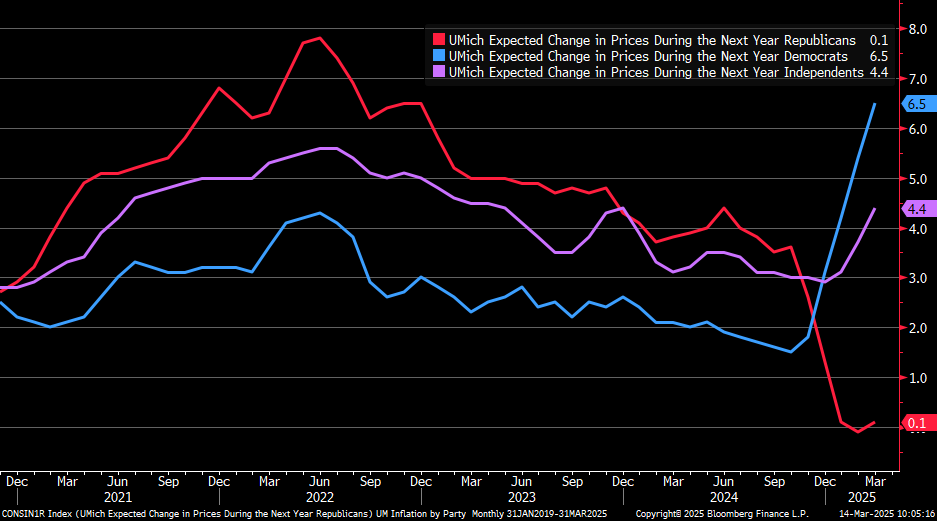

But again, looking closer, the headlines and the data are not aligned and there is a big clue for those that want to look objectively. University of Michigan Consumer Expectations in the Eonomy by Political Party show that Republicans are at a 95.7 confidence level while the Democrats are at 28.2 – which has never been lower! This reading is lower than during the pandemic and Financial Crash in 2008. Looking at inflation expectations, UMichigan data again, showed a massive difference by Political Party, with Dems expecting 6.5% inflation, Republicans 0.1%, and Independents a bit closer to the middle, although trending higher to 4.4%.

Inflation Projections by Political Party widened to levels never seen before.

So is it really that simple? Market uncertainty with negative headlines exacerbated to the extreme due to the extreme politically charged environment we find ourselves today.

Going back to the Fed last week, Powell had every opportunity to fan the flames further and speak to the increased risks to the economy from the tariffs, higher inflation, higher rates, etc. They did not. In fact, they kept the projected 2 rate cuts for this year which the market was worried were off the table. They also re-affirmed inflation projections, and that although we may see initial shock inflation pressures from the tariffs, long term projections are in line and may even reduce long term inflation. They also stated that starting in April they will reduce their treasuries taper from $25B/mo to $5B starting next month. This is important because it means the banks and Institutions will need to look elsewhere for yield, and because they have signaled that the rate cuts are still on the table for this year, it is likely that those institutions will finally look to the infamous MBS (Mortgage Backed Securities) for yield. As spreads between 30 year treasuries and MBS look to narrow to more historical levels (100 - 125 bps) expect Mortgage rates to start dropping in April. I personally think we will be at or sub-6% by June 2025. The Fed is paying attention and for the first time in a while, seemingly ahead of the curve here.

Zooming in to look at our Seattle Real Estate Market, Buyer Confidence remains high and market has shown further strengthening into March. Reviewing February Seattle Sold data, we saw almost 60% of homes sold in under 10 Days on Market (DOM), and 69% sold in under 30 DOM. March Pending data, is tracking at similar numbers with 59% Pending at 10 DOM, and 77% at 30 DOM or less. These numbers are extremely strong given the current environment we are in, and if we get relief on interest rates, which I think we will, bodes for an even stronger Spring and just maybe even our Summer market.

As always, follow the money, not noise.

By Anton K. Alexander, Elev8 Realty Group | Summit Properties NW

Welcome to my monthly newsletter, which will focus on the state of the market with a primary focus on Real Estate and the happenings and trends of the current day that affect and drive our Seattle Real Estate market. You will receive no more than 1 email per month by staying subscribed to this newsletter.

With over 15 years of real estate experience in the Greater Seattle Area and more than $550 million in sales throughout my career, I bring deep expertise and first-hand knowledge to every aspect of the real estate industry. Having also an overarching comprehension of the financial markets and real estate trends, I enjoy sharing market insights and helping Buyers and Sellers alike navigate the always changing real estate market. If you, or anyone you know is looking to Buy, Sell, or just talk real estate, please reach out! I am always available to talk real estate.

Until next time!